Spread Betting Tutorial - Lesson 2: Spread Betting Advantages

- Written by David Bet

In the past, financial spread betting was seen as an alitist product used largely by experienced investors. Now, more and more people are realising the value of this powerful trading tool. In this lesson you will look in more detail at the advantages of financial spread betting.

What are the advantages of financial spread betting?Over the past ten years, financial spread betting has exploded in popularity and now contributes to a significant volume of business on the London and Dublin stoc exchanges.

Financial spread betting has a number of major advantages over traditional methods of training:

- It is extremely cost-effective (with financial spread betting you pay no commission, stamp duty or any other fees on your trades)

- All your profits are tax free

- You trade on margin (it means that you only need to deposit a small percentage of the value of your trades, so you can put excess capital to good use elsewhere)

- You can profit from falling markets (because you are trading on the direction in whic a market is moving, as opposed to buying or selling the underlying market)

- You can use one account for a range of products (indivdual shares, foreign exchange, stock indices and commodities).

What is the benefit of traing on margin?When you trade on margin, you deposit just a small percentage of the value of each trade in your account. This is known as the initial margin required (IMR), multiplied by the value of your stake.

Using this relatively small amount of capital to trade on a market, as opposed to buying shares, is known as 'gearing' or 'leveraging'.

Gearing is a bit lik boxing above your wight - with smaller resources you may achieve spectacular results.

The power of gearing- Let's say ABC Limited is trading at £6 per share

- With spread trade, you can place a spread bet to buy £5 for every point change in the price. To do this, you need £300 (in this case) in your account. With share deal you can buy 500 shares at £6 each, but in this case it will cost you £3000.

- ABC Limited is now trading at £7 per share, an increase of £1 = 100 points.

- Both with spread deal and share deal, you make a profit of £500 (£5 stake x 100 points movement = £500).

So the profit is the same... or so it seems. Don't forget that the share dealer must also pay capital gains tax, stock broker's commission and stamp duty, which you do not when place a spread bet!

The other important point is that, as a spread trader, you can achieve your profit with a tiny outlay, relatively speaking. Your trade cost just £300, as opposed to £3000 to buy the shares in question. This illustrates the power of gearing (or leverage).

What level of control does financial spread betting give me?Financial spread betting offer flexibility and a level of control which you do not have with other form of trading.

It offers flexibility right through the duration of your trade. When things are going well, you can intervene and take a profit...and if your forecast are wrong, you can close your trade and cut your losses.

Financial spread betting also gives you control over your exposure to loss. You can decide in advance at what point you want to cut any losses. By using a closing order (stop loss), you can determine at what point you want to automatically close your position should the market move against you.

How does financial spread betting compare with traditional share dealing?Financial spread betting compares very favourable with traditional share dealing, most notably because you can profit both from falling and rising markets.

In falling markets, conventional investors may have to endure the loss in value of their investments... and if they have to sell any shares, they will either make a smaller profit or an outright loss.

However, as a spread trader, you can take full advantage of falling prices, and if the tide turns and prices start to regain the former value, you can also take the advantage of this recovery.

The holder of the same shares, on the other hand, can only watch the recovery, if it happens, and sigh with relief.

Is financial spread betting more cost-efficient than traditional share dealing?By comparison with traditional share dealing, financial spread betting is very cost-efficient.

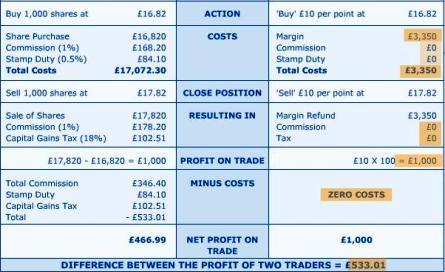

Take a look to the comparison between the costs involved in buying 1000 Coca-Cola shares and those involved in placing a 'buy' spread trade of £10 on the same market.

Remember that as a spread trader, you stand to gain £10 for every point Coca-Cola goes up. Equally, you are exposed to the risk that for every point Coca-Cola goes down, you will lose £10.

What is hedging?One of the biggest advantages of financial spread betting is that it may be used to offer protection against losses related to other activities - in your portfolio, for example, or due to exposure to a product such as oil. This is know as hedging.

You can protect the value of any shares that you might hold during times of uncertainty by opening a sell position in that share. This means you will profit from your short position if the value of the shareholding decreases.

How can I use financial spread betting as hedging tool?Suppose you have a large investment in shares and you consider the market is about to fall. Theoretically, you could sell your shares, wait for the market to fall, and the reinvest.

But that would incur broker commissions and capital gains tax. If the market doesn't fall you will have made a costly error.

In this case, placing a spread bet may be a better alternative - either on the individual shares or on the ralated index.

Shares: You place a 'sell' trad (go short) on the major stocks in your portfolio so that if the market does drop (lowering the value of your shares) you make a compensating profit on your spread trade.

Index: Allternatively, instead of placing a trade on the movements of individual shares prices, you place a trade on the movement of the index which has the closes match to your portfolio. If your portfolio is made up lare blue-chip companies, a spread on the FTSE 100 would be an appropriate hedge.

Summary

- Financial spread betting offers you the opportunity to make large profits by investing a fraction of the value of trade because you are trading on maregin. This is known as geraing or leverage.

- Financial spread betting compares very favourably with traditional share dealing, because you can make profits from both rising and falling markets with a much smaller initial outlay.

- Financial spread betting is cost-efficient and flexible and allows you a greater level of control than is the case in other types of trading.

- You can use financial spread betting as a hedging tool to protect actual share portfolios or as a shield against exposure in other financial areas.

You might also be interested in:

Spread Betting Tutorial - Lesson 1: Overview